Made Easy with Acceptance Tax & Accounting

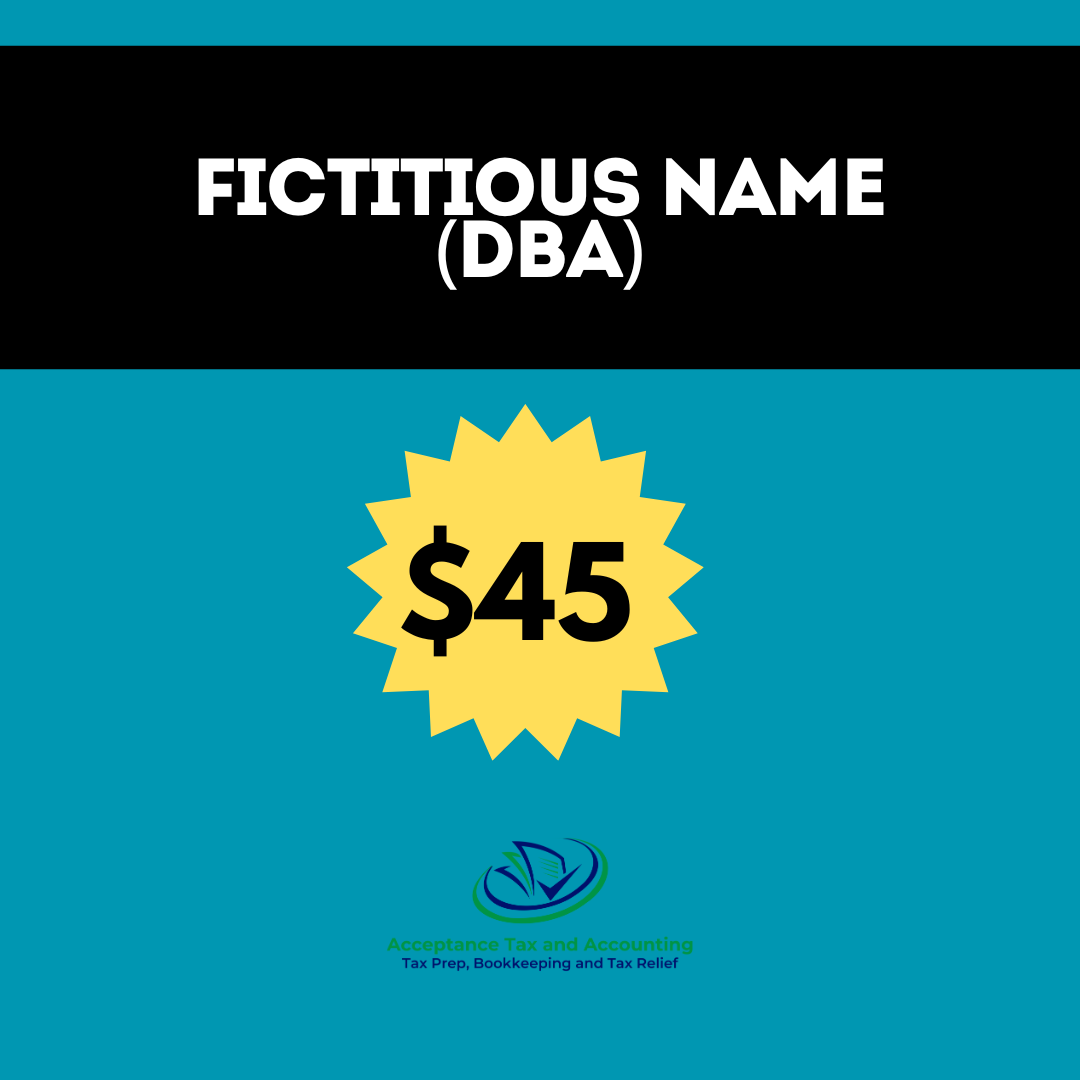

Looking to form a corporation in Florida or start your Florida LLC? Acceptance Tax & Accounting provides professional, reliable Florida business formation services tailored to your needs. Whether you want to create a Florida S Corporation, C Corporation, Limited Liability Company, Nonprofit, Professional Corporation, or register a DBA (Fictitious Name), we simplify the entire process.

We handle filing all required paperwork with the Florida Division of Corporations, ensuring your business is legally established quickly — typically within 3 to 5 business days. With our expertise, you avoid costly mistakes, unnecessary delays, and confusing legal jargon.

Our dedicated customer support team is available by phone, email, or chat to answer your questions and guide you through every step of your Florida business formation.

Start your Florida business confidently — partner with Acceptance Tax & Accounting for fast, accurate, and affordable corporation and LLC formation services.

<DBA Learn More

What Kind Of Business Do I Need? Not Sure?

View our Business Type Comparison Chart to see what best suits your specific incorporation needs.

Common Questions

What is a corporation?

A corporation is a separate legal entity that exists independently from its owners. A corporation comes into existence when articles of incorporation are properly created and maintained, filed with the prescribed fees, and accepted by the Florida Secretary of State.

Why should I incorporate?

The single most important reason people cite for forming a corporation or LLC when they do business is to safeguard the personal assets of the owners

How do I start?

Articles of incorporation must be filed with the State of Florida along with the required fees (Our Setup services handles this step for you)

When will my business be formed?

Depending how quickly the state processes the filings, it will take between two and five business days to set up your corporate entity