As a business owner, you juggle a lot — sales, operations, customer service, and everything in between. But if your bookkeeping isn’t accurate and up to date, it can quietly drain your profits and cause major headaches at tax time.

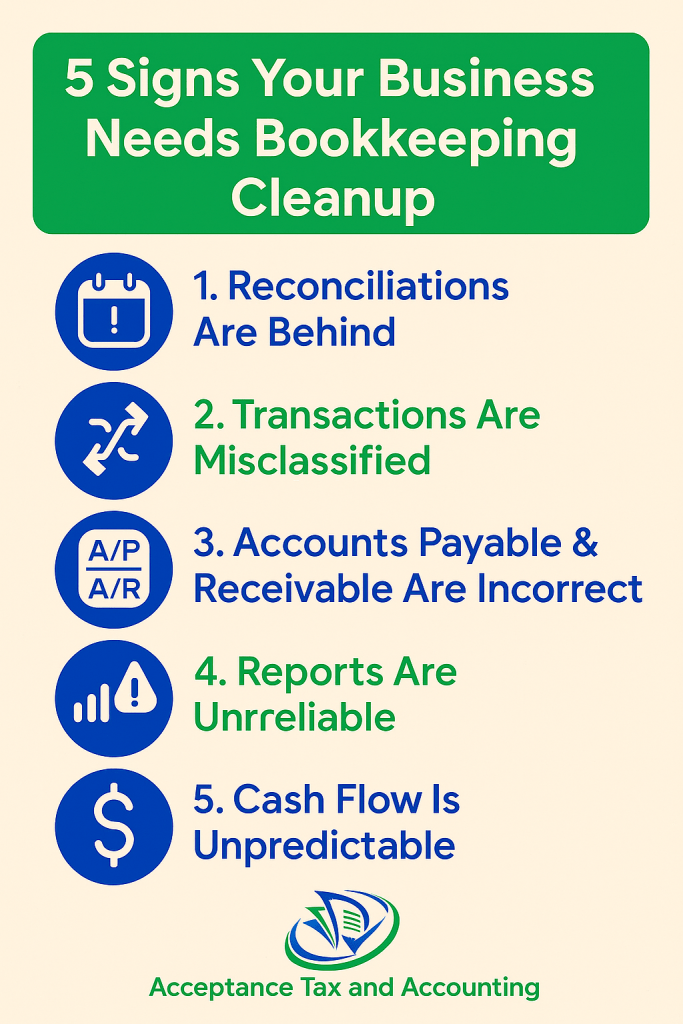

Many entrepreneurs don’t realize their books are messy until it’s too late. Here are five clear warning signs your business needs a bookkeeping cleanup:

1. You’re Behind on Recording Transactions

If you haven’t entered income and expenses for weeks (or months), you’re running blind. Without up-to-date records, it’s impossible to know your true cash flow or profitability. Falling behind also means more stress during tax season when everything piles up at once.

2. Your Bank Account Doesn’t Match Your Books

Reconciling your accounts should be a regular habit. If your bank balance and your bookkeeping software show different numbers, something’s wrong. It could be duplicate entries, missed expenses, or even fraud. Regular reconciliation keeps your records accurate and your business protected.

3. You Can’t Easily See How Much You Owe (or Are Owed)

Are unpaid invoices slipping through the cracks? Do you know exactly how much your business owes vendors right now? If not, your books aren’t giving you the insights you need. A cleanup ensures your Accounts Receivable and Accounts Payable are reliable so you can manage cash flow better.

4. Tax Time Feels Like a Panic Attack

Do you scramble every year to pull together receipts, spreadsheets, and bank statements? That’s a sign your bookkeeping system isn’t working. Properly cleaned-up books make tax filing smooth and stress-free — and they help you avoid costly penalties or missed deductions.

5. You’re Making Decisions Based on Guesswork

If you’re not confident in your financial reports, you can’t make smart business decisions. Clean books give you clarity on your true profit margins, expenses, and growth opportunities. Without accurate numbers, you could be underpricing your services, overspending, or missing growth opportunities.

✅ The Good News: It’s Fixable

Messy books don’t mean you’re a bad business owner — it just means you’ve been busy running your company. A professional bookkeeping cleanup gets your finances back on track, so you have reliable numbers, smooth tax filings, and peace of mind.

At Acceptance Tax & Accounting, we help entrepreneurs and small business owners clean up their books quickly and efficiently, so you can focus on growing your business instead of stressing over numbers.

👉 Ready to get your books in order? Schedule a free consultation today

Leave a comment